About Us

Our Vision

Our vision is to be a social impact enterprise supporting upward fluid economic mobility across all socioeconomic statuses, and be a catalyst to drive social change at the grassroot levels, to help break the cycle of poverty and lay the foundation to build a financially inclusive world where everyone has equal opportunity to participate in/contribute to economic growth and build sustainable wealth and prosperity.

Our Mission

Our mission is to spread global awareness about the social cause of financial inclusion and be a champion for promoting/increasing financial inclusion for the un/underbanked, underserved & underrepresented communities, youth, excluded minorities, women enterprises (including helping reduce gender inequalities), and MSME’s, by undertaking several projects/initiatives with a goal to provide a global platform and build a global community of changemakers for promoting financial literacy, affordable & fair access to capital, adoption of inclusive and sustainable innovations through FinTechs, and advocacy through positive actions for related public policies, thereby empowering and enabling economic opportunities, social equity, & overall financial well-being.

What We Do

At Fluid Ice Foundation, we aim to be a social impact catalyst through our several movements/initiatives.

We offer free 1-on-1 literacy classes, workshops, and have created a library of resources to help people make better and more informed financial decisions. We have also launched a completely free, online, and self-paced Financial Literacy Essentials (FinLitE) course, as a part of our FinVerse Academy.

Not everyone has access to the tools and services to achieve their financial autonomy. With an aim to create opportunities for underserved communities, we have carefully reviewed and created a list of key FinTech services, considering cost, ease of access, and ease of use, to get started on the journey towards financial independence.

With an aim to be a catalyst for enabling global sustainable/disruptive innovation, we offer a free platform/ecosystem of resources, that can be leveraged by entrepreneurs, investors, partners, affiliates, etc. Additionally, through focused research and insights, we aim to raise awareness about critical global issues pertaining to social equity/overall inclusivity.

We are promoting and supporting local/community based financial institutions globally who serve underserved and underrepresented communities. To this end, we have published/compiled a list of credit unions and cooperative banks globally.

It is essential for both policymakers and the global community to work together to address challenges/impediments to financial inclusion. As part of our digital advocacy efforts, we have identified key/illustrative public policies in the US for financial inclusion, that you can learn more about to help improve and support financial inclusion.

With an aim to gather empirical data, conduct objective analysis, drive focused insights, and develop benchmarks, helping shape effective social/financial inclusion initiatives, we have developed market surveys in 4 key areas: 1) financial independence, 2) financial education/literacy, 3) student loans, and 4) investing behaviors.

Meet Our Global Advisory Board

Meet Our Georgia Chapter Team

Join our Team

We are always looking to grow our team, full of individuals with a passion for financial inclusion.

We are authorized to issue the President's Volunteer Service Award (PVSA) to our team members and volunteers for their hours.

Our Partners and Supporters Who Make Our Vision Possible

Partner with Us

We are always looking to expand our partner relationships. If your organization shares our vision, we would love to partner with you and work together to achieve our goals.

Our Social Impact Strategy

To provide financial education and resources to help work towards financial self-sufficiency.

To empower community's grassroots by mobilizing & promoting social capital & local financial institutions.

To reduce the digital divide, through FinTechs, improving financial services access in remote areas.

To raise awareness for financial inclusion through social outreach movements and public policies.

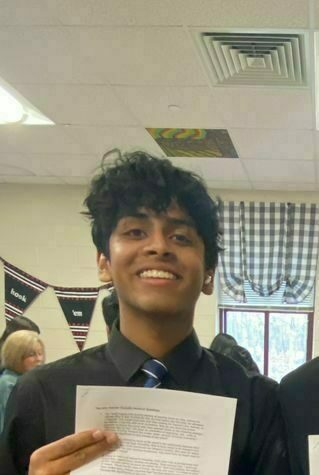

Raj Mehta – Financial Education Instructor

Raj Mehta – Financial Education Instructor